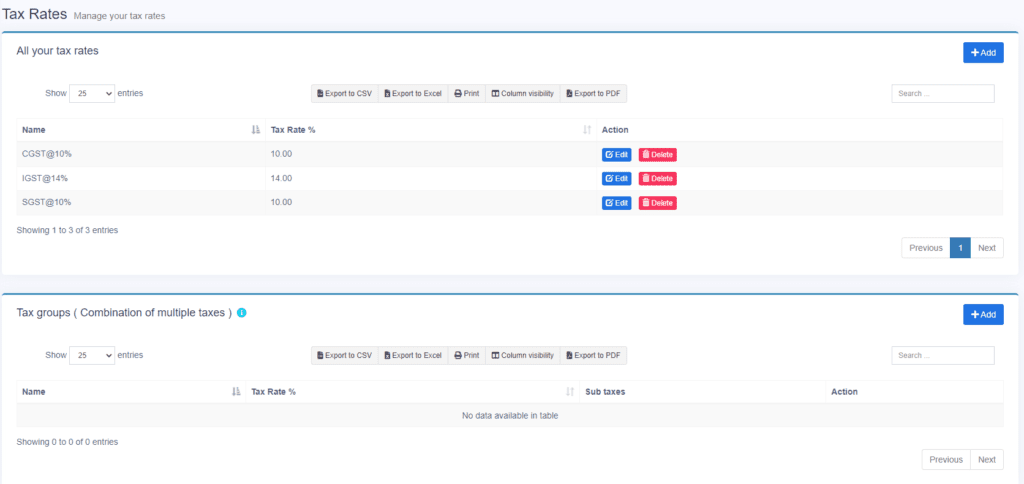

3 Different taxes in India:

- CGST (Central Goods & Services Tax)

- SGST (State Goods & Services Tax )

- IGST (Integrated Goods & Services Tax)

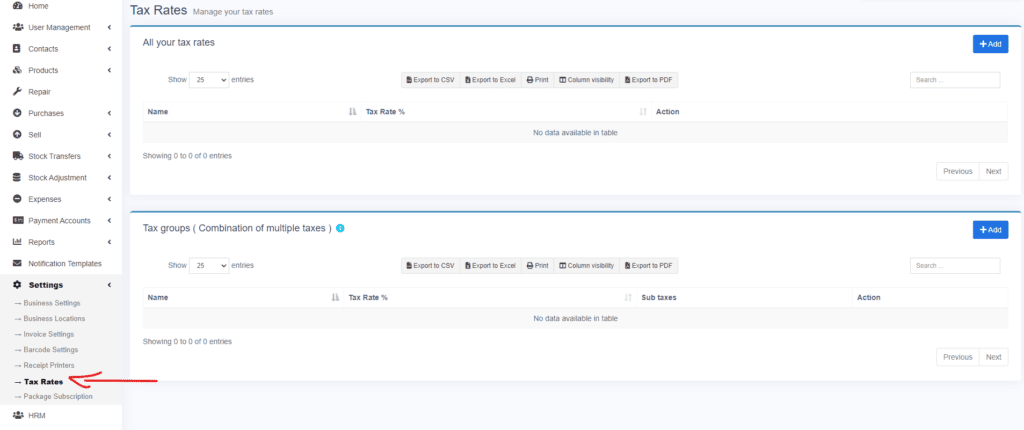

Go to Settings -> Tax Rate setting.

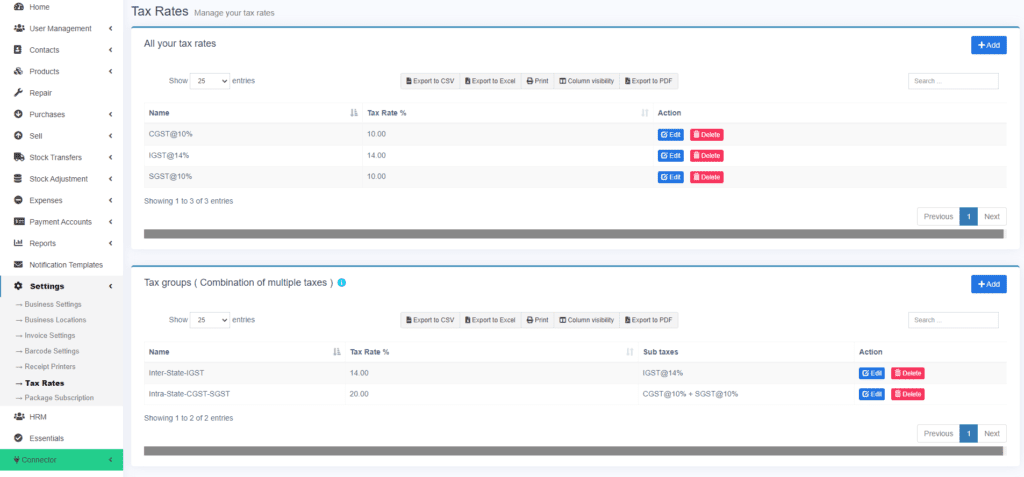

1. Create a tax with name CGST@10% and Tax Rate %: as 10. (10% is for example only, use the tax rate applicable)

2. Create a tax with name SGST@10% and Tax Rate %: as 10. (10% is for example only, use the tax rate applicable)

3. Create a tax with name IGST@14% and Tax Rate %: as 14. (14% is for example only, use the tax rate applicable)

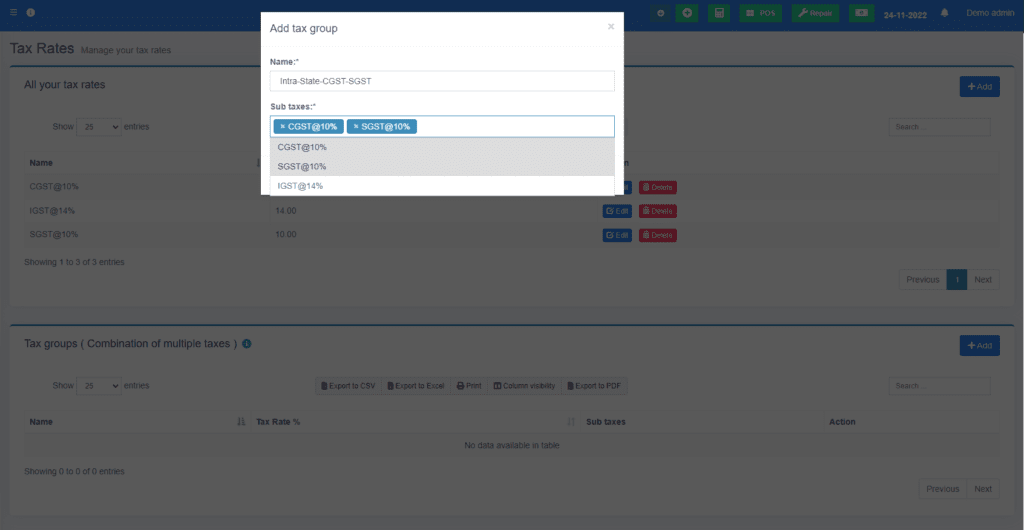

4. Below the Tax rate, it shows “Tax groups ( Combination of multiple taxes )”. Create on Add, enter the tax group name as Intra-State-CGST-SGST, and select sub-taxes CGST@10% & SGST@10%.

5. Below the Tax rate, it shows “Tax groups ( Combination of multiple taxes )”. Create on Add, enter the tax group name as Inter-State-IGST, and select sub-taxes IGST@14%.

With this now when you purchase or sell a product you can select the applicable tax.

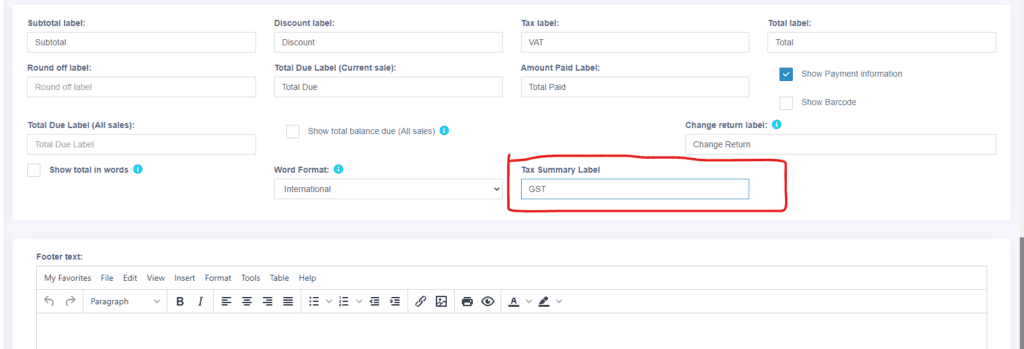

DIsplay Tax Summary in Invoice #

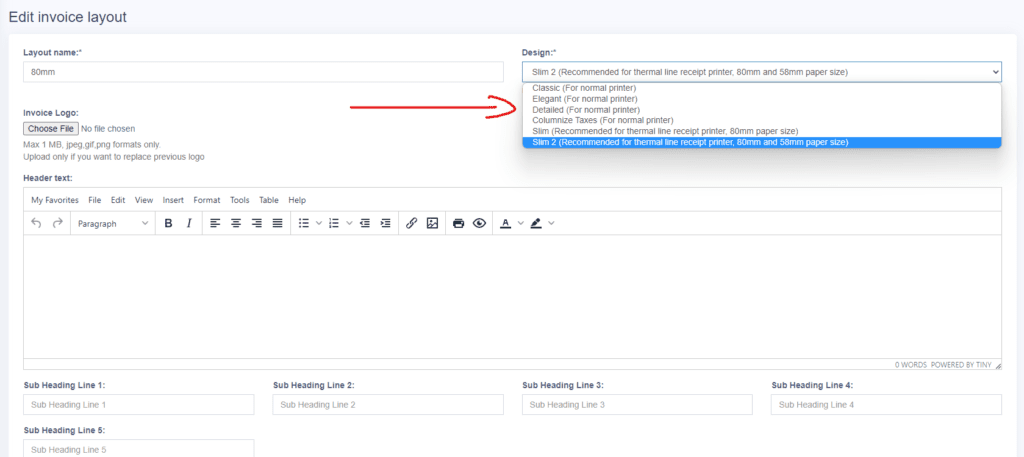

Check the details guide on invoice format & designs

- To display the summary of tax in the invoice – add the label “Tax Summary Label”

- To see inline tax try using the columised tax design or detailed design or Elegant or classic as per your need.